Industrial robots have been put into operation since the middle of the 20th century and now the market has a forecast CAGR of over 25% from 2020 to 2025. However, it wasn’t until 30 years ago that robots entered the realm of medicine, driven by the demand for systems that offer less invasive surgery as compared to traditional procedures.

As of today, it is Intuitive Surgical, Inc. (Nasdaq:ISRG, public company) that dominates the overall robotic surgery market. Founded in 1995, Intuitive Surgical is the pioneer of robotic-assisted and less invasive surgery. It sells robotic systems, instruments, accessories, and services to hospitals. Today, the company is headquartered in Sunnyvale, California, and works with more than 3,000 hospitals worldwide.

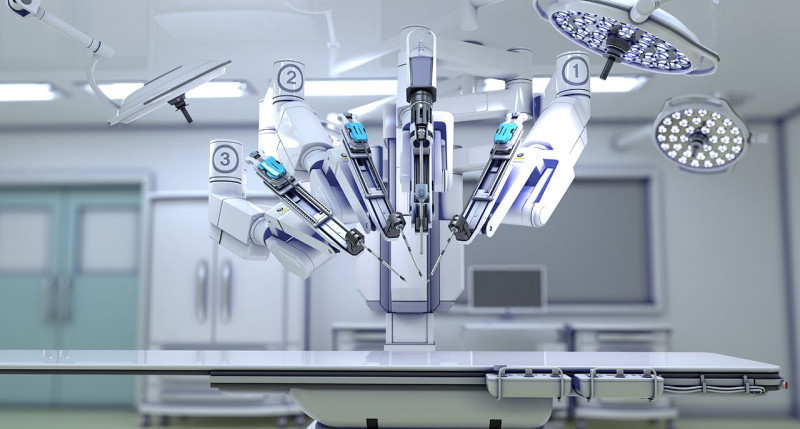

While Intuitive Surgical’s leadership is due to its da Vinci systems, as iData Research noted, the company’s success is “mainly fueled by revenue from procedures and service and maintenance fees”. As of 2020, 56,3% of the company’s sales constitute instruments and accessories, 27% — surgical systems, and 16.6% — services. The United States accounts for 68% of total sales. Engineered with 3D vision and advanced motion control, the da Vinci Surgical System is now the most popular surgical system used by surgeons in 67 countries worldwide. The system can perform complicated surgeries and replicate the actions of human arms while offering greater stability and accuracy. The product was among the first robotic-assisted surgical systems cleared by the FDA.

Intuitive Surgery’s Partnerships & Agreements

Twenty years ago, Intuitive Surgical started with $6 per share but the situation dramatically changed in 2003, when the company merged with its main competitor at the time — Computer Motion. Computer Motion entered the robotic surgery area prior to Intuitive Surgical and had a competitive product — the ZEUS Robotic Surgical System, which was approved in Europe but not in the USA. The ZEUS system was phased out right after the merger.

Within the following years, the company’s share price increased tenfold and in 2017, it exceeded $100 for the first time. The same year, the total revenue of Intuitive Surgical was reported at $601 million, up 61% compared to the previous year. Since 2015, both annual profit and revenue have been generally on the rise. And so was profit margin — until the COVID-19 pandemic. That surge in performance was due to the sales growth and the increased number of surgical procedures.

In August 2016, Intuitive Surgical signed a deal with Dextera Surgical (private company) to create surgical staplers and cartridges for da Vinci systems. Dextera Surgical is a company producing stapling devices for minimally invasive surgical procedures. According to the deal, Intuitive Surgical develops the robotic-compatible stapler system, whereas Dextera Surgical focuses on the stapler cartridge. It is noteworthy that Dextera President and CEO Julian Nikolchev is also Senior Vice President for corporate development and strategy at Intuitive Surgical since 2019.

In July 2019, Intuitive Surgical acquired the robotic endoscope portion of Schölly Fiberoptic’s business. The takeover allowed the company to integrate Schölly’s robotic endoscope production line into its operations. This includes two manufacturing sites in Germany — Denzlingen and Biebertal — and one repair site in Worcester, USA. As a result of this takeover, Intuitive Surgical managed to strengthen its supply chain and increase its production capacity.

In May 2020, Intuitive Surgical was awarded a five-year $420 mln contract with the Defense Logistics Agency to supply surgical robots, instruments, and their related accessories. The Defense Logistics Agency is a combat support agency in the U.S. Department of Defense. Located in 28 countries, DLA manages the global supply chain for the U.S. Army, Navy, Air Force, Space Force, etc. While this amount of money will account for just 2% of Intuitive Surgical’s revenue, the contract makes the Pentagon the largest customer of the company. It is not the first time that Intuitive Surgical wins this contract from DLA. What is worth noting is that the number of other companies competing for the contract has increased threefold and now exceeds one hundred.

Why Do Intuitive Surgery’s Share Prices Drop?

Last year, Intuitive Surgical’s stock reached an all-time high and at the beginning of 2021, the share price was as much as $825. Then it started to decline. On January 22, the company shares traded at $744 and, after a short recovery in the first half of February, the price decreased further to $685 per share. As of March 29, 2021, Intuitive Surgical shares are sold at $724. So what happened? The shares dropped the next day following the release of Intuitive Surgical’s full earnings results on January 21, 2021. The company announced that it placed only 936 surgical systems in 2020, down from 1,119 systems in 2019. Revenue fell 3% as the result of delays in surgical procedures as hospitals focused on coronavirus patients.

A significant adverse factor is a COVID-19 pandemic and, in particular, a new wave of coronavirus cases. According to the company, the resurgence of the coronavirus pandemic has and will have an unfavourable influence on procedure volumes, which means there is much uncertainty.

“During 2020, da Vinci procedure volumes and system placements were significantly impacted by the COVID-19 pandemic, as healthcare systems around the world diverted resources to respond to COVID-19. The impact of the COVID-19 pandemic on the Company's business has, and continues to, differ by geography and region. In the U.S., for example, while da Vinci procedures had recovered a significant portion of the pre-COVID-19 levels, the resurgence of COVID-19, particularly later in the fourth quarter and into January, has had, and will likely continue to have, an adverse impact on the Company’s procedure volumes. Due to the continued uncertainty around the scope and duration of the pandemic globally, we cannot, at this time, reliably estimate the future impact on our operations and financial results,” says the company’s press release published on January 21.

Hospitals pay more attention to fighting the coronavirus instead of purchasing new surgery equipment. Additionally, many surgical operations, as well as diagnostics, have been delayed all over the world. As Gary S. Guthart, President of Intuitive Surgical said at an earnings conference call, “This delay in diagnostic pipelines will likely take several quarters to resolve, even after the threat of COVID begins to abate”.

This resulted in fewer systems being installed in 2020. Even worse, the trend is unlikely to improve in the short term because hospitals would prefer to use up the existing capacity before buying new systems. Nevertheless, many observers see good prospects for Intuitive Surgical, and there are reasons for that. First, the company is still an undoubted leader in the market, with its da Vinci systems dominating the market. Secondly, the surgical robotics market is on the rise. And thirdly, it has become harder to clear and register a new robotic system in both the U.S. and Europe. This means that it will take longer for competitors to market their products, something that Intuitive Surgical will obviously benefit from.

Leadership & Shareholders

Intuitive Surgical was founded by Dr. Frederic Moll, a medical device developer, who was called a “father of robotic surgery”. Moll left the company in 2002 to set up Hansen Medical. Over 88% of Intuitive Surgical shares are held by institutional investors, which is more than the industry’s average. Out of them, 53.8% are mutual fund holders, 34.6% other institutional investors, and only 3% are individual stakeholders. The largest shareholders are American investment companies that include T. Rowe Price Group, Inc. (8%), The Vanguard Group, Inc. (7.3%), BlackRock Fund Advisors (4.7%), Fidelity Management & Research Co. (4%), and SSgA Funds Management, Inc. The top 12 institutional shareholders have the combined ownership of 50% in Intuitive Surgical. As for insider shareholders, I would mention CEO Gary S. Guthart, Chief Financial Officer Mohr Marshall, Board Member Levy Alan who own and trade the company’s shares. In May, Guthart sold 16,914 shares for $12.9 million.

In April 2020, Craig H. Barratt, Ph.D., became a new chair of the company’s Board of Directors. He has been the Board member for nine years and holds 7,635 shares of Intuitive Surgical. Barratt is also Chairman of Calysta, Inc. and on the board of IonQ, Inc., Baraja Pty Ltd., and Atmosic Technologies, Inc. A 58-year-old Barratt is a co-inventor of several patents in the field of wireless communications and medical imaging. He is the author of BackupPC, a free disk-to-disk backup software suite, and the original version of PSfrag.

Previously, Barratt served as Senior Vice President of the Connectivity Group of Intel Corporation and held different roles at Google, Inc. He was President of Qualcomm Atheros, the subsidiary of Qualcomm Inc., and Director of Atheros Communications, Inc. Barratt holds a B.E. in Electrical Engineering and a B.S. in Pure Mathematics and Physics from the Australian University of Sydney. He also received a doctorate from Stanford University.

Unlike Barratt, Intuitive Surgical’s CEO Gary S. Guthart grew up with the company. He joined its first engineering team in 1996 and worked as a Control Systems Analyst until he was appointed Vice President of Engineering three years later. In the 2000s, Guthart held positions of Sr. Vice President of Product Operations and President of Intuitive Surgical. Prior to this, he worked at SRI International and was engaged in the development of computer-enhanced surgery technology. Guthart started his career at NASA, as part of Human Factors Lab’s team, where he wrote software that would help to evaluate the performance of pilots when they are under stress.

Apart from Intuitive Surgical, Guthart is a Board Member of Illumina, Inc. and the Silicon Valley Leadership Group — an organization that includes representatives of companies operating in the valley with the aim of influencing public policy. He holds an M.S. and a Ph.D. in Engineering Science from the California Institute of Technology. Guthart’s estimated net worth is about $19.5 mln.

The company’s leadership puts a special focus on services. Most Intuitive’s systems are connected to the cloud for monitoring and software updates. Another product, the cloud-enabled SimNow simulation platform, is a simulator designed to help surgeons learn and practice their skills. SimNow is compatible with da Vinci systems and can be connected to the internet. Presenting Intuitive’s perspective on “Surgery in the Age of Computing” during the Society of Robotic Surgery's 2020 Annual Meeting, Gary Guthart said:

“I think the pressure on our healthcare system will increase as we move through COVID, getting good outcomes measurably so that patients recover quickly and recover at home. The change to cloud-based analytics and routine use of local analytics, I think, is powerful and transformative. The beginning of investment and realization in the field of cloud computing, real-time aids, and real-time learning capabilities are fantastic and are going to power change”.

What Are the Other Major Medical Robot Industry Players?

The surgical robotics market is on the rise and is expected to reach approximately $13.3 billion by 2026, according to Research&Markets. The key drivers for growth include increasing demand for automation in the field of healthcare and cutting-edge robotic surgeries. In recent years, there have been significant technological advances in 3D-imaging, microscopic cameras, data recorders, motion sensors, remote navigation, and more.

The fastest-growing market of medical robots is that of the United States. As of March 2020, Intuitive Surgical has placed 5,669 Da Vinci systems all over the world and more than half of them were installed in the U.S. About 10% of procedures in the United States leverage robotics, whereas in other countries this figure is only 1%.

At present, Intuitive Surgical occupies over 90% of the global market for robotic surgical systems, aside from orthopedic surgery robots. While the da Vinci system remains the top choice for hospitals, there are a plethora of companies offering other innovative medical robots. Indeed, Intuitive Surgical is facing real competition. In particular, Johnson & Johnson, Zimmer Biomet, and Medtronic have recently launched their robotic platforms. Like Intuitive Surgical, many competitors like J&J and Stryker also reported a decline in their businesses in 2020 due to the COVID-19 pandemic.

Hansen Medical (private company)

Hansen Medical is another California-based company founded by Frederic Moll. It manufactures the Magellan Robotic System and the Sensei Robotic System. The former performs peripheral vascular robotics procedures while the latter is intended for interventional electrophysiology procedures. In 2016, the company was acquired by Auris Health for $80 million. Two years later, Auris Health introduced the Monarch™ Platform. The system has become the first robotic platform for diagnostic and therapeutic bronchoscopic procedures that was cleared by the FDA. In 2019, Auris Health was acquired by Ethicon, which is part of the Johnson & Johnson Medical Devices Companies.

Johnson & Johnson (NYSE:JNJ, public company)

Established in New Jersey in 1886, Johnson & Johnson produces medical devices, pharmaceuticals, and consumer products. J&J is one of the world’s most valuable companies. In 2015, Verily and Johnson & Johnson’s Ethicon launched as a joint venture, Verb Surgical, but in 2019, J&J purchased the remaining stake in the company. At present, Verb Surgical is developing a platform for robotic surgery. This autumn, Johnson & Johnson unveiled details for its new robotic surgical system that is expected to compete with the da Vinci robot — Ottawa. Clinical trials of the 6-arm Ottawa system are planned to start in 2022.

After acquiring Auris Health with its Monarch system, Johnson & Johnson got a 1.7% share of the global robotic surgical market. Additionally, Dr. Frederic Moll has entered the company’s executive team. Moll is now Chief Development Officer at Johnson & Johnson, whose knowledge and experience help the company to create a new robotic system.

Medtronic (NYSE:MDT, public company)

Another serious competitor is Medtronic, an American medical device company with $29 billion in annual revenue and owned mainly by institutional shareholders. With headquarters in Ireland and an office in Minnesota, the company operates in 120 countries. Medtronic is developing a new Hugo system that will rival da Vinci robots. The company’s newly-appointed CEO, Geoff Martha, said they have ambitious goals and are going to expand the market share.

“We believe that [Medtronic's] robot might be better for a certain category of procedures than [Intuitive Surgical's] platform which could result in a form of segmentation among hospitals,” said analysts at Needham & Co.

Stryker Corporation (NYSE:SYK, public company)

One of the key competitors in the robotic surgery market is Stryker, a Michigan-based American corporation with a rich 80-year history. It is one of the world’s leading medical technology companies that makes implants for joint replacement, surgical equipment, and endoscopic systems. Its Mako™ Robotic Arm used in knee and hip arthroplasty is the most profitable product in the orthopedic robotics market. Stryker’s products are sold directly to hospitals and doctors in the U.S. and 100 other countries all over the world. Institutional shareholders own 74% of Stryker’s shares while 15% belong to individual stakeholders. John Brown, who ran Stryker Corporation for 32 years before retiring, is a Forbes 400 billionaire and owns around 5% of the company.

Zimmer Biomet Robotics

Headquartered in Montpellier, France, Zimmer Biomet Robotics, also known as Medtech SA, was set up in 2002 by Bertin Nahum, a French-Beninese entrepreneur in surgical robotics. In 2016, Medtech was purchased by the Indiana-based Zimmer Biomet Group (NYSE:ZBH, public company) and renamed Zimmer Biomet Robotics. Its main product, ROSA®, is a multi-application platform that assists surgeons during cranial and spine procedures. The system is already used in more than 100 hospitals in Europe, the USA, Asia, and the Middle East. ROSA was FDA-cleared for knee, brain, and spine surgeries in 2019.

Smith & Nephew (NYSE:SNN, public company)

Smith & Nephew plc is a British medical equipment company with headquarters in Watford. Founded in 1856, the company produces arthroscopy products, orthopedic reconstruction products, and more. In the summer of 2020, Smith+Nephew announced the launch of a next-generation Cori surgical system with a portable modular design. It is a handheld surgical system that uses a new bone milling technique and intuitive software. According to GlobalData analysts, Smith & Nephew will become “a key player in the robotics surgery market” thanks to its unique robotics platform.

Kuka (KU2:Xetra, public company)

Kuka AG, the German manufacturer owned by the Chinese company Midea Group, first put its medical robots into operation in 1999. Today, its robots are used in both diagnosis and surgery. The company has a lightweight robot LBR Med and a robot with a payload capacity of 500 kg. In partnership with the medical product manufacturer Accuray, Kuka created the CyberKnife — the first commercially available robot-guided radiation surgery system.

Medrobotics (private company)

Headquartered in Raynham, Massachusetts, Medrobotics Corporation offers products for minimally invasive surgery. Its main product is the Flex® Robotic System providing access to hard-to-reach anatomical areas. This system was FDA-cleared in 2015 and obtained the European CE mark in 2014. In 2017, the company raised $20 million for the development of a next-generation robotic surgery system and expanding the use of the existing platform.

Diligent Robotics (private company)

Diligent Robotics was established in 2014 by two female robotics experts: Andrea Thomaz and Vivian Chu. Born in California, Vivian Chu is an American roboticist, a daughter of software engineers. Andrea Thomaz has a B.S. in Electrical and Computer Engineering from the University of Texas. She is an expert in AI, robotics, and human-robot interaction. The company builds AI-empowered, socially intelligent robots and is known for its autonomous Moxi robot designed to complete routine activities and aid nurses. The company is now a leader in the social robotic sector. Last year, Diligent Robotics announced that it raised a $10 million series A investment.

Aethon (private company)

Aethon is owned by ST Engineering, a Singapore-based engineering company with a revenue of $6.6 billion. The company is located in Pittsburgh and makes the world’s number one autonomous robot for supply delivery and room sanitizing in hospitals. At the backdrop of the COVID-19 global pandemic, the demand for such robots is expected to grow.

Medical Robots in Asia

China, Korea, Japan, Singapore, and Thailand are increasingly buying medical robots from abroad and design their own systems, too. Their governments support the development of new technologies, with billions spent on robotics. Although the da Vinci system has been used in over 60,000 operations in China, the country’s government is set to reduce the dependence on foreign technologies by supporting domestic manufacturers. There are two dozens of medical robot producers in China, with five of them being the most noticeable.

The first one is Chongqing Jinshan Science and Technology, a private manufacturer of gastrointestinal medical devices. In 2004, Chongqing Jinshan started its first capsule endoscope, which was later approved by the US FDA. Recently, the company launched research and development projects to create a minimally invasive surgical robot system. The Beijing-based Tinavi (688277:Shanghai) public company is growing at a rate of 150% and enjoys the support of China’s Ministry of Science and the Beijing Government. It produces robotic guided systems used in orthopedic surgeries. In 2010, Tinavi became the first Chinese manufacturer to obtain a permit to make an orthopedic robot.

Beijing Bohuiweikang Technology established 10 years ago by Professor Liu Da to produce the Remebot stereotactic neurosurgery robot system. Midea-Yaskawa, a joint venture between Chinese Midea and Japanese Yaskawa, was created to make nursing care and rehabilitation robots. In 2020, Midea closed the joint venture. According to Yaskawa, the cooperation ended as a result of the conflict interests caused by Midea's takeover of KUKA AG. And finally, there is Shenzhen Sanggu, a subsidiary of the Chinese company Silver Star Group, which is engaged in the production of robots used in the preparation of intravenous medication. That said, China’s medical robot industry is still in a transition stage from R&D to mass production. Rehabilitation robots account for the largest segment in the Chinese market.

In Korea, Curexo (KOSDAQ: 060280, public company) purchased the medical robotics division of Hyundai Heavy Industries and launched the production of Robodoc, a system used in knee and hip replacement surgeries. In Japan, as a result of cooperation between several universities and companies, a cost-effective endoscopic robot EMARO was created.